Finance Minister AMA Muhith presented the national budget of Tk 4.0 trillion for the fiscal year 2017-18 on 1, June 2017. This is his 11th budget, ninth at a stretch. He placed the budget in the parliament with a target of 7.4 per cent growth of the Gross Domestic Product (GDP).

In his budget speech, Mr. Muhith said that he wanted to contain annual inflation rate within 5.5 per cent.

Centre for Policy Dialogue gave its analysis of the proposed National Budget FY2017-18 at a press briefing on Friday, 2 June 2017.

Here are the key features of the CPD observation on the impact of the proposed budget on industries, investment and employment.

MACROECONOMIC AND PUBLIC FINANCE FRAMEWORK

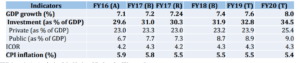

The GDP growth target for FY18 has been set at 7.4% (7.24% in FY17, provisional). CPD observed that moderate improvement in GDP growth and drastic improvement in public investment forecasted as the private investment as a share of GDP is expected to rise by 0.2 percentage points only. The civil society think tank estimated that an additional (approx.) Tk. 66,000 crore private investment will be required in FY18 while additional (approx.) Tk. 50,000 crore will be invested by public sector in FY18 and ICOR is expected to rise marginally (decline in capital productivity) in FY18. CPD observed that inflation is expected to remain stable at 5.5% and terms this questionable. It said that CPD in its last week’s report on the state of the economy observed that while achieving the growth figures has dominated attention, it has not been able to create more jobs in the economy. CPD said that the budget speech mentioned that “around 20 lakh workers enter our labor market each year” but the recent Labour Force Survey (2015-16) report shows that this is far from true. “Between 2013-2016, labour force in Bangladesh increased by only about 4.7 lakh each year. Job creation has also slowed down – about 4.7 lakh each year. Same as labour force! Unemployment rate remained almost unchanged (4.2% in FY2016)”, the paper reads.

Growth, Investment and Inflation

FISCAL MEASURES

In the budget speech it is mentioned that companies making payment in relation to its promotion must deduct 1.5% of the payment as tax and conditional tax exemption is to be introduced for infrastructure sector. CPD said that this may prove to be a good move to attract investment in infrastructure depending on the conditions. CPD observed that clarification of the conditionality is required.

“Coverage of tax exemption has been extended for the income derived from the business of information and communication technology (ICT) sectors while 8 more sectors added to the existing list containing 14 sectors, now total is 22– this will promote development of ICT sector which has significant potentials. Income of Alternative Investment Fund will be waived of tax, but tax will be imposed if profit is distributed instead of re-investment,” the report reads.

VAT and SD Act 2012

VAT and SD Act 2012 will come into force from 1 July 2017. Uniform and single VAT rate has been proposed to continue at 15% for next 3 years. CPD observed that FM did not clearly mention whether rate will be changed/brought down after 3 years. VAT-free annual turnover threshold has been raised to Tk. 36 lakh from Tk. 30 lakh. Earlier business has to pay package VAT for annual turnover of Tk. 30 lakh. CPD observed that the measure will benefit small businesses. Threshold for turnover tax has been raised to between Tk. 36 lakh and 1.5 crore from existing Tk. 30 lakh-80 lakh with imposition of 4% turnover tax. The Civil Society think tank said that raising the ceiling will keep higher number of SMEs out of VAT net. However, they have to pay turnover tax at a higher rate of 4% which was 3% in FY17. It said that to avail VAT credit, businesses have to procure inputs from VAT registered entities. It said that many small businesses remained outside the VAT net and were informal in nature. It mentioned that SRO has been issued to promote procurement from various VAT registered manufacturing industries (SRO no 135-ain/2017/21 Customs). It said that businesses have to take new 9-digit VAT registration; according to VAT administration promotion – existing BIN will become obsolete from 1 July 2017. CPD observed that FM did not mention the number of VAT registration so far.

“8.5 lakh entities are reported to be VAT registered while only 32 thousand pay taxes,” it reads.

CPD said that plan to increase the number to 60 thousand – should have been more ambitious. It said that no clear implementation plan for enforcing the Act has been mentioned and no assessment of additional revenue generation from implementation of the Act has been made public.

“Effective implementation of the Act will remain uncertain and challenging,” the paper reads.

“The proposed tax structure outlined in the budget would increase both production cost and living cost in the country,” CPD Distinguished Fellow Debapriya Bhattacharya told the brief briefing.

“Already, the price of rice is in an upward trajectory while the prices of oil and gas have already increased. At the same time, the exchange rate of Taka is also likely to go downward in the coming months,” he added.

Corporate Tax

The budget proposed that tax rate is to be reduced to 15% from 20% for knitwear and woven garments’ export earnings. It will be reduced to 14% for RMG companies which has factories with internationally recognized green building certification. CPD terms the initiative encouraging and time appropriate considering environmental welfare. However, it said that the foregone revenue should have been mentioned. CPD also observed that this reduction is discriminatory for other sectors.

CPD Research Director Dr Khondaker Golam Moazzem said that corporate tax is reduced mainly to increase investment. He said that corporate tax was reduced in the recent years but private investment has not been increased to a satisfactory level. He said that country’s investment environment is to be blamed for this.

He said that it is not clear how the reduced corporate tax will increase investment in the RMG sector

“We proposed that the incentives should be given in the export mechanism. Our proposal was to increase cash incentives for exports in non-traditional markets. The idea is : incentives are given after the investor is successful to export. However, the budget proposals did not reflect recommendations in the RMG sector,” he said while speaking at the press briefing on 2, June 2017.

Budget FY18 proposed to bring down the corporate rates for non-listed banks, nonlisted mobile operators and cigarette manufacturing companies gradually. Rates for these are higher than 40% (42.5%, 45% and 45% respectively). CPD observed that reduction of the corporate taxes on cigarette manufacturing companies will be against pro-health tax policy being pursued by the government and need to be maintained at current levels

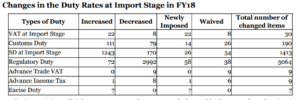

Major changes in SD rates

According to VAT and SD Act 2012, SD was to be levied only on 256 items at import stage. However, according to OTS 2017-18, SD is imposed on 1,674 tariff lines at import stage. It was argued that, it was done to ensure protection of the domestic industries. CPD observed that, SD has been increased for a number of items where Bangladesh Tariff Commission had proposed to reduce the rate (i.e. Fuel oil nes, Motorcycles (incl. mopeds) capacity not >50 cc etc., dried mangoes).

“SD has been increased to 25% from 20% for major industries such as shrimp and live fish, plastic and plastic products, jute yarn. SD has been increased to 50% from 45% for RMG and glass and glass ware industry. The increased SD rate may provide protection to relevant domestic industries CPD said that it is expected to generate additional revenue. At the same time, the measure may increase tax burden for importers and a number of sectors will suffer from higher cost of doing business. CPD also said that product-specific tax incidence could not be estimated because NBR data uploaded on its website do not reflect the changes observed in the Finance Act and Customs SROs

Prices may increase for the following products:

CPD said that prices may increase for the following products: Fast food, snacks; Foreign salt; Baby food; Crushed milk, butter; Dry grapes, any kind of fresh fruit; Exotic sweet biscuits and biscuit like foods (waffles, wafers, etc.); Mineral water (up to 3 liters), soft drinks, energy drinks, Autorickshaw, electric battery-powered motor vehicle, CC vehicle, four-door double cabin pickup, two and four stroke auto-rickshaw/three wheeler engine; Battery used in private car, oven, foreign made mobile set, memory card, SIM card; Bathtub Shower Bath, Sink, Wash Basin, Bidet, Lavatory, IPS and UPS; Ceiling fan and its parts; Color and varnish; Cosmetics; Fabrics, carpets; Foreign shoe; Fuel oils, paintings, varnishes, imported solar panel; mosquito coil, aerosol and mosquito repellants; motor vehicle tires; paints, powder, shampoo, scented bath salts and other goods, ceramic wall tiles and bathtub; plastic products, plastic doors, windows, frame; poultry feed or poultry meal; rod; room perfume; shirt-suit-jacket, trouser, blouse, various types of foreign clothes, silk or silk woven fabrics; soap, similar products and detergents; stainless steel sync, tableware and kitchenware used in kitchen; toothbrush; air ticket; various types of bags

Prices may decrease for the following products

CPD said that prices may decrease for the following products: 93 kinds of medicines for emergency survival, Other medicines, including cancer-resistant medicines, air Conditioner Parts; Faro silicon; hybrid motor cars; LD Gas Cylinder below 5000 liters; Local battery; locally assembled motorcycles and mobile sets; Locally made laptops, tabs, cellular phones and iPads; Locally made refrigerator, air conditioner, LPG gas cylinder, computer raw materials, Fertiliser, seeds, pesticide, salt, fish/meat, rice, sugar, palm oil, soybean oil, crashed rice, vegetables, and maize; Foreign toilet paper, tissue paper, towel or napkin paper and homogeneous products, hair care products; Talcum powder, Leather industry equipment; Glue (glue), Products for agriculture, fisheries, poultry and dairy product, Tubes and hose pipe; Various products of ceramic products including bathtub, sink, wash basin

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh