Published in The Financial Express on Thursday, 10 November 2016

Bangladesh-China emerging partnership

The window of opportunity

Mustafizur Rahman

By all accounts, the recent visit of the Chinese President Mr. Xi Jinping has been a cause for a lot of excitement and expectations in Bangladesh. The visit and its outcomes were reported extensively and commented upon in great details, both in the print and electronic media of the country; the general public also followed the visit with great interest. The present write-up dwells on three aspects in connection with this visit: (a) its economic significance, (b) the outcomes, and (c) how Bangladesh should strategise to gain the most from the window of opportunity that this visit has opened up.

By all accounts, the recent visit of the Chinese President Mr. Xi Jinping has been a cause for a lot of excitement and expectations in Bangladesh. The visit and its outcomes were reported extensively and commented upon in great details, both in the print and electronic media of the country; the general public also followed the visit with great interest. The present write-up dwells on three aspects in connection with this visit: (a) its economic significance, (b) the outcomes, and (c) how Bangladesh should strategise to gain the most from the window of opportunity that this visit has opened up.

ECONOMIC SIGNIFICANCE: China is the single most important trading partner of Bangladesh – according to trade map data, in 2015 China’s export to Bangladesh was to the tune of about 13.9 billion USD. Indeed, over the past years China has gradually replaced India as Bangladesh’s most important import-sourcing country. Bangladesh’s export-oriented industries depend significantly on import of cotton, fabrics, equipment, iron and steel from China; Bangladesh’s domestic enterprises depend on Chinese machinery; a large part of consumption demand is met from imports of Chinese consumer goods. Thus, both domestic market-oriented and export-oriented sectors in Bangladesh have come to rely, to a large extent, on Chinese imports. Indeed, Bangladesh is not alone in this ascendancy of China as a trading partner. China has emerged as the preeminent trading counterpart of India, with Indian imports from China exceeding 61.6 billion USD in 2015.

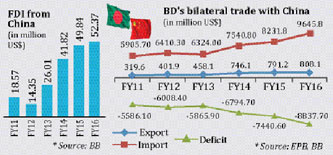

As is known, on the basis of purchasing power parity, China now ranks as the number one economy in the world. Its imports amount to 1,682 billion USD. Many developing economies are taking advantage of closer economic ties with China, particularly those in Asia and Africa. Thus, the critically important factor from the Bangladesh perspective is whether she will be able to benefit by deepening economic cooperation with the fast growing Chinese economy, through greater exports to, and by drawing larger investment flows from, China. Till now, against the aforesaid import of over 13.9 billion USD, Bangladesh’s export to China had been only about 804 million USD in 2015. This is only 0.05 per cent of China’s annual import of 1,682 billion USD for that year. Attracting Chinese investment that targets the Chinese market (as also the global market) is key to reducing the bilateral trade deficit with China, by taking advantage of the growing import market of China. However, the major impediment to expanding Bangladesh’s export to China is associated with supply-side constraints in Bangladesh. From this viewpoint, Chinese investment in Bangladesh leaves a lot of opportunities to be tapped. In 2015, FDI (foreign direct investment) from China to Bangladesh was worth a mere 70.0 million USD out of a gross total of 2.7 billion USD (2.6 per cent). If FDI flow from Hong Kong (worth 174.0 million) is added to this, the combined flow would account for about 10 per cent of the inward FDI flow to Bangladesh in 2015. Total FDI stock, till 2015, from China and Hong Kong (859.0 million USD) was only 6.6 per cent of Bangladesh’s total FDI stock of 12.9 billion USD. A large part of Chinese FDI is concentrated in one sector – textiles and weaving (about two-thirds). There is now an opportunity to stimulate and encourage Chinese investment by attracting Chinese investors in a big way, particularly in special economic zones (SEZs), of which Bangladesh has already offered a dedicated one to China. Favourable environment will encourage Chinese investment in non-SEZ areas as well. One recalls that, in 2015 total FDI outflow from China was to the tune of 188.0 billion USD.

As a least developed country (LDC), Bangladesh is a beneficiary of the duty-free initiative of China under the WTO which offers duty-free market access to a large number of exports originating from the LDCs. Indeed, China was the first developing country to respond to the Hong Kong Ministerial Meeting’s decision as regards duty-free market access to be given for at least 97 per cent of all goods exported by all LDCs (for 8,036 items out of 8,285 items at 8-digit level). An analysis of Bangladesh’s export potentials in the Chinese market indicates that a number of products including lower-end apparels, leather and footwear items, jute products and pharmaceutical items have good export opportunities in China. If Bangladesh is able to diversify her export base and supply-side capacities, China with its growing middle class and increasing purchasing power could offer an excellent market opportunity for Bangladesh. Here, Chinese (as also Indian and other) investment targeting the Chinese market, taking advantage of the current duty-free access, could play an important role. At an opportune time, Bangladesh should request China to offer duty-free market access for all her export products, under flexible rules of origin (the RoO under the Canadian GSP programme – at 25 per cent of domestic value addition-could be considered in this regard).

OUTCOMES OF THE VISIT: As is known, a number of Agreements, MoUs and business deals, both Government to Government (G to G, worth about 24.5 billion USD for 28 projects) and Business to Business (B to B, worth about 13.6 billion USD for 13 deals), were signed between the two countries during the visit of the Chinese President. Many of the proposed Chinese projects are geared to putting in place the necessary infrastructure in Bangladesh including those related to power generation, capacity building of ports and establishment of transport connectivity. These will help remove some of the key bottlenecks that undermine Bangladesh’s competitiveness in domestic, regional and global markets. Earlier, Bangladesh had shown keen interest in getting Chinese support for a number of projects including expansion and modernisation of Mongla port facilities, extension of underground mining operation in Bara Pukuria, construction of coal-powered thermal plant, conversion of meter-gauge to broad-gauge track from Akhaura to Sylhet, BPDB’s pre-payment metering project and construction of a marine drive expressway in the southern coastal belt. At the time of visit of the Chinese President agreements and MoUs were inked to implement many of these projects. Addressing the formidable investment bottlenecks will hopefully stimulate a larger flow of FDI from China as also from other countries.

Duty-free offer of India to Bangladesh also creates opportunities for Chinese (as also Indian) investment in Bangladesh targeting the Indian market. China’s excess supply capacity and the declining competitiveness of some of her sunset industries open up investment opportunities for Chinese FDI in Bangladesh. As an LDC, under the WTO decision on Services Waiver, Bangladesh is set to get preferential market access to some segments of the services market in the developed countries. The decision of the Nairobi WTO Ministerial meeting has allowed special treatment for pharmaceutical exports from the LDCs such as Bangladesh (DF market access, waiver from licensing/patenting obligations etc. till 2031). These should create new opportunities for Chinese FDI in Bangladesh.

The BCIM-Economic Corridor (BCIM-EC) is an important initiative which could open up new opportunities for Bangladesh, not only through development of economic zones and activities along the corridor, but also by opening up the large hinterlands of South Western China and North-East India to gateways offered by Bangladeshi ports of Chittagong, Mongla and Payra (and the proposed deep-sea port in the Bay of Bengal if and when the decision to build this is taken). Connecting with the One Belt, One Road (OBOR) initiative through various routes, to ensure seamless transport connectivity with China, India and Southern Asian region will enable Bangladesh to take advantage of her strategic location. This should be seen in the context of other developments in the region and sub-region: BBIN Motor Vehicle Agreement (BBIN-MVA), Southern Silk Route, Trans-Asia Road and Rail Networks, initiatives as part of SAARC and BIMSTEC and others. The resultant seamless connectivity will enable Bangladesh to translate her comparative advantages into competitive advantages through cost-effective movement of goods and development of efficient value and supply chains. This could help emergence of Bangladesh as a regional transport hub, creating opportunities for significant export of services. Indeed, in the coming days, Southern China, North-East India, Myanmar and Bangladesh could build a growth quadrangle by deepening trade, investment, transport and people to people connectivities.

Bangladesh is now at a stage where she will need to graduate from a ‘factor-driven economy’ to a ‘productivity-driven’ economy. Here also Bangladesh could benefit from collaboration with China. Transfer of technology could be yet another opportunity from the viewpoint of deepening Bangladesh-China bilateral relationship. As is known, China has developed effective technologies for high productivity agriculture, exploitation of marine resources and deployment of satellite technology for better use and management of resources. China’s support for ushering in a new technological frontier in agriculture, skills development and exploration and exploitation of resources in the Bay of Bengal zone could strengthen Bangladesh’s efforts towards accelerated economic growth and enhanced welfare of her people.

Support from the Asian Infrastructure Investment Bank (AIIB), established at the initiative of China could also be harnessed to mobilise additional funds towards the much-needed infrastructure development in Bangladesh. Indeed, Bangladesh is a founding member of the AIIB and was the recipient of AIIB’s very first loan in developing her power sector. A recent World Bank study shows that Bangladesh will need more than a hundred billion dollars over the next decade to develop her infrastructure in power, road/rail transport, electricity grid, transmission lines etc. China, with its huge forex surplus funds and formidable skills and technical knowhow could be a key partner of Bangladesh in going forward in building the needed infrastructure for the twenty-first century.

STRATEGIES TO BE PURSUED: It is important that Bangladesh strategises smartly to gain the most out of her emerging and multifaceted bilateral ties with China. There is a need to closely examine the terms and conditions of the loans including interest rate, repayment period, grace period, provision for making (a part of) loans into grant, procurement rules, competitive bidding, insurance provisions etc. Suppliers’ credit and their tied nature often give rise to problems at later stages of implementation; these should be avoided through careful and well-prepared discussions. At the same time, Bangladesh’s own preparedness to implement such large-scale investment projects, over relatively short span of time, is an issue that ought to be given highest priority. It is critically important that the proposed projects are implemented with transparency, good governance and due accountability. Institutional capacity building, placement of specialised and skilled cadres capable of implementing these projects, deployment of Project Directors based on track record and meritocracy, implementation of the projects on time and in a cost-effective manner — all these will call for urgent attention of policymakers at the highest level. Regular monitoring and reporting will play an important role in this regard. This is crucial to ensure that the projects deliver the expected outputs and the Bangladesh economy benefits from these investments. Bangladesh will also need to carefully prepare for the increasing Debt-GDP ratio and the consequent higher debt-servicing liabilities. As is known, Bangladesh’s track record has been quite commendable on both counts. However, the need for careful preparation in this regard cannot be overemphasised when this is considered in the backdrop of the recent experience of some of the developing countries.

This is an era of variable geometry, and for Bangladesh all routes should matter. Cooperation with China offers a critically important route in this connection and Bangladesh should seize the emerging opportunities in view of this. It is Bangladesh’s good fortune that she is a neighbour to two of the rising global economic powerhouses – China and India. Deepening economic ties with these two economies should be at the centre of Bangladesh’s strategies in going forward in the twenty-first century which is set to be an Asian Century. Thus, from the Bangladesh perspective, the visit of the Chinese President ought to be seen as an opportunity to realise her ambition of graduating from the lower middle-income to the upper middle-income status of development at an accelerated pace in the foreseeable future. Keeping this transformative journey in the mind, Bangladesh should explore all possible avenues to seize the opportunities offered by China’s interest to build a strategic relationship of Comprehensive Cooperation Partnership with Bangladesh.

Dr Mustafizur Rahman is Executive Director of the Centre for Policy Dialogue (CPD). mustafiz223@gmail.com

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh