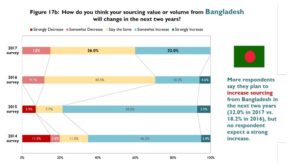

The 2017 Fashion Industry Benchmarking Study reveals that overall, respondents are cautious about expanding sourcing from Bangladesh in the next two years, with only 32 percent expecting to somewhat increase sourcing from Bangladesh, and none expecting to substantially increase sourcing from the country. The report said that respondents were much more optimistic about Bangladesh in 2015 and 2014 when as many as 42 percent and 50 percent of respondents, respectively, planned to expand sourcing there (Figure 17b).

The report said that this year, Bangladesh is the #7 sourcing destination, with 61 percent of respondents sourcing there, slipping from #5 (70 percent usage) in 2016. It said that “Made in Bangladesh” enjoys a prominent price advantage over many other Asian suppliers.

“However, respondents say sourcing in Bangladesh is high risk; since compliance is so important to companies, this risk level could be holding them back from increasing sourcing there,” the report said.

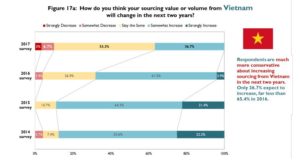

The report also said that for the first time since they began conducting the study, no respondent plans to strongly increase sourcing from Vietnam in the next two years.

It said that U.S. fashion companies intend to source more from Vietnam and Bangladesh in the next two years, but imports from the two countries may grow at a relatively slow pace.

“This year, Vietnam unsurprisingly remains the #2 sourcing destination among respondents (88 percent usage rate). However, respondents are much more conservative about Vietnam’s growth potential in the next two years, possibly due to the United States’ withdrawal from the Trans-Pacific Partnership (TPP) and increasing labor costs. While those expecting to increase sourcing from Vietnam fell Page 21 of 29 Note: Utilization rate equals the frequency of each free trade agreement/preference program’s utilization divided by the total number of respondents. sharply from 65 percent in 2016 to only 36 percent, those expecting no change climbed to 53 percent from 27 percent,” the report added.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh