Published in New Age on January 07, 2018

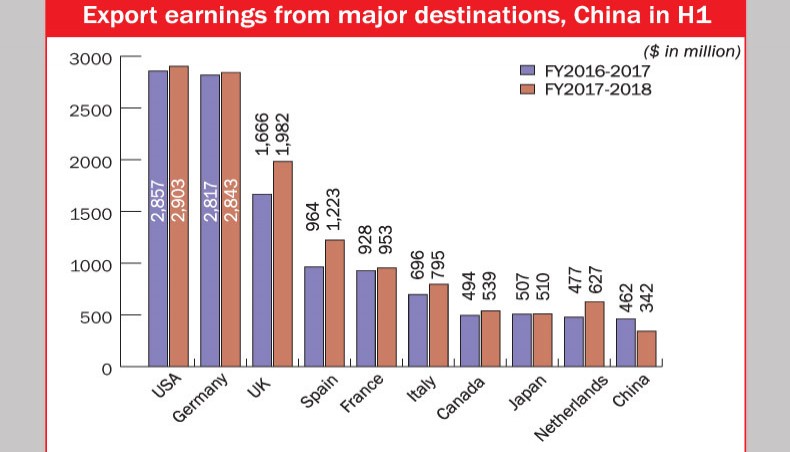

Country’s export earnings from United Kingdom, the third largest market for Bangladesh, soared by 19 per cent in the first half of the current fiscal year compared with the same period of last FY due to surging garment exports against Brexit fears.

Export earnings from another European country, Spain, also posted a healthy growth of 27 per cent in H1, riding on garment exports.

But, export earnings from China, where exports had increased last year, slumped by 26 per cent in July-December due to lower demand of leather and leather goods and garments.

Earning growth from two major markets, USA and Germany, remained tepid during the period although both economies continued to do better.

Experts and exporters said that Bangladeshi exports to UK rebounded strongly this fiscal year as initial fear over the Brexit, the separation of Britain from European Union, had subsided while pound sterling made a moderate recovery.

Exports earning from UK rose to $1.98 billion in July-December of financial year 2017-2018 from $1.66 billion in the same period of FY 2016-2017.

In H1 of FY17, earnings from UK posted a negative growth of 2.93 per cent year-on-year.

Garment exports to the UK market grew 20 per cent to $1,850.17 million in H1 of FY18 from $1.53 billion during the same period of FY17.

Although there are still concerns that Brexit would affect UK economy when it takes full effect, the recent negotiation between UK government and EU leaders has given positive indication about a possible deal, said an economist.

As a result, the UK economy is still performing well while the rise of exchange rate of pound, which slumped to around Tk 101 in July, 2016, but went up to Tk 112 in recent weeks, has helped Bangladesh exporters, he said.

He said as Bangladeshi garment exporters manufacture lower-end products, the recent rise in inflation in UK had driven consumers to lower end items.

Besides, export earnings from other major EU countries, except Germany, surged in H1, with 27 per cent growth in earnings from Spain, 14.23 per cent from Italy, 31 per cent Netherlands and 24 per cent from Poland.

Exporters said that the recovery in value of Euro against the taka and increasing sourcing of garment products by big brands like Zara and H&M had helped Bangladeshi exports to grow in these EU markets.

Exporters said that the earnings from Germany remained almost static at $2.84 billion in H1 of FY18 compared with that of $2.81 billion during the same period a year ago.

They said that the growth in garment exports in German market remained lacklustre in July-December after growing over 20 per cent during the H1 in FY2017.

Earnings growth from the major export market, US, also remained almost static with only 1.6 per cent despite the strong economic growth and consumer confidence in US.

Among the markets, China, however, remained the most disappointing as earnings from the Asian country fell by 26 per cent in H1 compared with the same period of last FY. In H1 of FY17, earnings from China had posted 32 per cent growth.

Exporters said that slump in raw leather and leather goods and garment exports to China resulted in the slump.

Leather exporters said that shifting of tanneries from Hazaribagh to Savar had affected production as many of the factories could not begin production at the Savar estate in time.

Earnings from raw leather and leather goods exports from China fell by 47 per cent to $63.16 million in H1 of FY18 from $ 118.79 million in H1 of FY17.

Garment export earnings from China also fell to $166.97 million in H1 from $189.51 million in H1 of FY17.

Export earnings from another promising Asian market, Japan, was also unremarkable in H1, standing at $509.57 million against $ 506.98 million during the same period a year ago.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh