By Bill Donahue

Published in Bloomberg on March 02, 2018

Photo: Nichole Sobecki For Bloomberg Businessweek

The project is Beijing’s big experiment in outsourcing, and a $10 billion shot in the arm for the African nation—if there isn’t a civil war first.

Standing in a sunny office in Indochine International’s brand-new factory, Raghav Pattar, vice president of this Chinese apparel manufacturer, is ebullient. It’s November, barely six months since the Hawassa Industrial Park opened, and already he has 1,400 locals at work. Pattar is shooting to employ 20,000 Ethiopians by 2019. “Twenty-four months ago, the land we’re sitting on was farm fields,” he says. “What country can change in 24 months? That is Ethiopia!”

Pattar is a bright-eyed émigré from India, with apparel experience in Bangladesh and Egypt. He keeps his pens neatly clipped in the pocket of his blue button-down oxford, and right now he’s gazing out the window toward the factory floor, where scores of women are sewing seams, stamping logos, and pressing out wrinkles for Warner’s underpants, a brand sold mainly at Walmart. “The government is very committed to us,” he says. “They had workers here 24 hours, day and night, to build this place. And there is no corruption. None!”

Hawassa Industrial Park did go up quickly, thanks to a state-owned Chinese construction company that banged out 56 identical hangar-size, red-and-gray metal sheds devoted to textile production in nine months, for $250 million, according to the Ethiopian Investment Commission. But Pattar is effusing this way because he has a visitor, Belay Hailemichael, the soft-spoken park manager who runs the “one-stop” help center. Belay enables companies to snap up import and export licenses and executive visas and processes prospective workers. These are mostly women, who’ve taken long, dusty bus rides here from small villages and waited for hours to apply for jobs with a base salary of about $25 a month. The help center gives them a dexterity test and divides them into three categories: gifted “ones,” fated to work the sewing machines, and less talented “twos” and “threes,” who will pack boxes and sweep floors.

We’ve arrived at a new moment for the global apparel industry. This drought-afflicted, landlocked country of 100 million on the Horn of Africa is transforming itself into the lowest rung on the supply chain that pours out fast fashion and five-for-$12.99 tube socks. Lured by tax incentives, promises of infrastructure investment, and ultracheap labor, countries the Western world once outsourced production to, particularly China and Sri Lanka, are now the middlemen ramping up production here for Guess, Levi’s, H&M, and other labels. These industrialists like Ethiopia because the government wants them as much as they want cheap labor and tax breaks. The Hawassa Industrial Park’s inauguration is only the most recent part of a vast centralized scheme: Since 2014, Ethiopia has opened four giant, publicly owned industrial parks; it plans eight more by 2020.

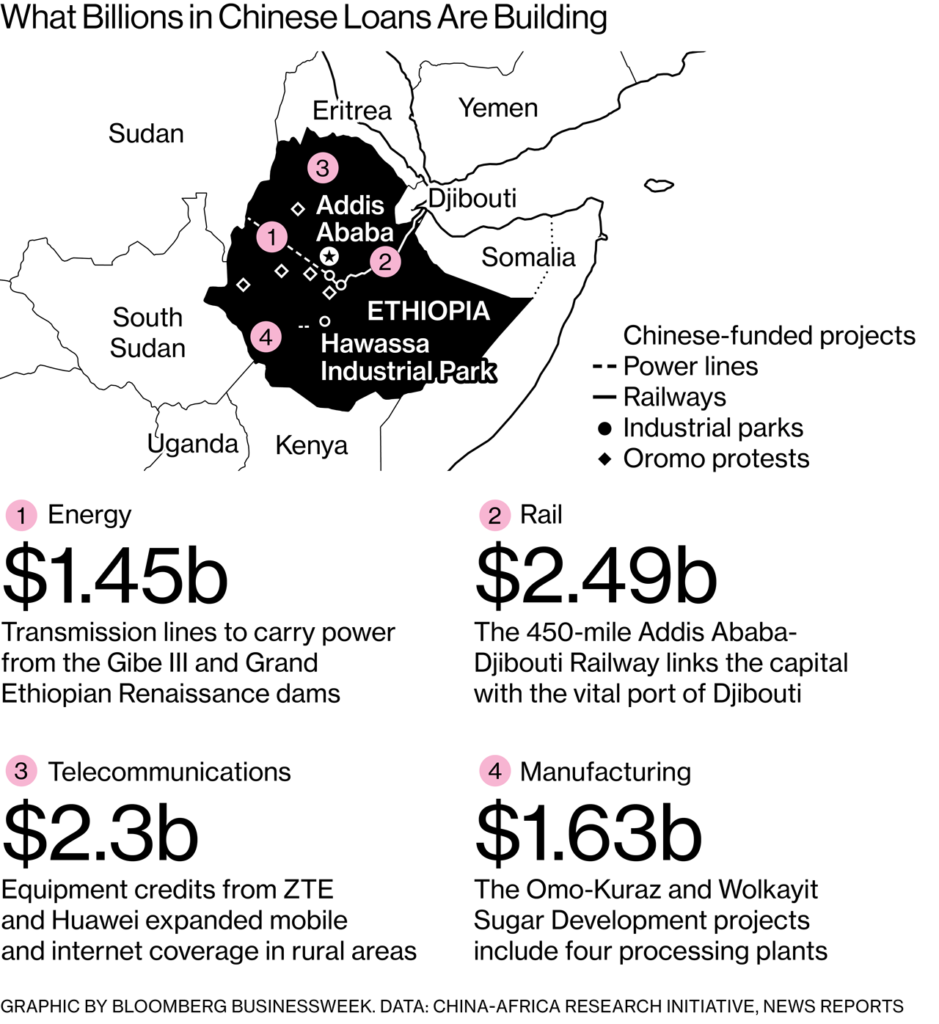

The industrialists who set up shop here are exempt from income tax for their first five years of business and absolved from duties or taxes on the import of capital goods and construction supplies. Ethiopia can swing such largesse because it gets lots and lots of money from China: $10.7 billion in loans from 2010 to 2015, according to the China-Africa Research Initiative at the Johns Hopkins University School of Advanced International Studies. Right now much of the money is being spent on lucrative contracts for Chinese companies that, with help from Ethiopian labor, are building dams, roads, and cellular networks. This infrastructure, the Ethiopian government says, will allow the country to join the global middle class. “The plan is to create a total of 2 million jobs in manufacturing by the end of 2025,” says the Ethiopian Investment Commission’s Belachew Mekuria. “We are an agrarian nation now, but that will change.”

If there isn’t a civil war first. At the Summer Olympics in Rio de Janeiro in 2016, marathon runner Feyisa Lilesa drew the world’s attention to a crisis brewing in his country. As he crossed the finish line to win silver, he raised his arms in an “X”—an antigovernment symbol. Feyisa belongs to the country’s largest ethnic group, the Oromo. Since 2015 the Oromo have been staging mass protests to decry, among other things, what they say are land grabs from farmers for an autocratic government’s planned factories. The Ethiopian People’s Revolutionary Democratic Front (EPRDF) controls every seat in Parliament and claims to represent all of Ethiopia’s 70-plus ethnic groups, but its power is largely held by the Tigray, who constitute only 6 percent of the population. In the years of unrest, hundreds of Oromo have died, factories have been burned, and many dissidents have been imprisoned.

In mid-February the Ethiopian government surprised the country by releasing hundreds of prisoners—a salve for the Oromo and, perhaps, the investors upon which Ethiopia’s transition relies. In a corollary gesture, Prime Minister Hailemariam Desalegn resigned. On state television, he said it was “vital in the bid to carry out reforms that would lead to sustainable peace and democracy.” One of those prisoners was Oromo leader and Addis Ababa English professor Bekele Gerba. But on Feb. 26 the EPRDF muddied its message by detaining Bekele at a roadblock. Mohammed Ademo, the editor of OPride, a popular website carrying Oromo news, predicted “an unprecedented wave of protests and a bloody crackdown.” Hours later, Bekele was set free again.

The Hawassa park hasn’t ignited mass protests. Those have largely been nearer to Addis Ababa, in the Oromia region. The 500 subsistence farmers displaced by the park, which is in the countryside on the edge of the small city of Hawassa, are ethnically Sidama, a group that pulls little political weight. But their accusations of land grabs echo the Oromo’s. Urese Dinsa, a 69-year-old farmer and ex-chairman of the political ward where the park stands, says he was tricked by a promise of $37,000 and jobs for his children in exchange for leaving the 2.5-acre plot he’d farmed for 17 years. He actually received $6,000, which was more than many other farmers got. He notes that in the beginning many of the displaced women secured factory work, but now “there are less than 10 still there.” The regimented days are unfamiliar. “They get only 30 minutes for lunch,” Urese says. “Their backs hurt. They are exhausted. Those jobs, they make everyone sick.”

Many of the park’s managers, primarily Sri Lankans brought in to impart the efficiencies achieved in their country’s sweatshops, would view this comment as epitomizing one of their main complaints: Ethiopia’s history hasn’t equipped its citizens for the rigors of industry. “Ethiopia has never been colonized,” says David Müller, who moved from Sri Lanka (his name comes from his German father) to be the human resources manager for Hela-Indochine, a joint Chinese-Sri Lankan apparel venture in one of the park’s sheds. “There’s a sense of pride about that, and a little pushback comes with it.”

Efficiency is a problem, and Müller is strict. All of his employees begin by undergoing a five-day induction program focused on personal hygiene, grooming, and discipline. “It’s a tough journey,” Müller says, en route to a high-ceilinged cafeteria, “and sometimes they don’t get it.” (Müller has since left the company.)

One Ethiopian college graduate, who doesn’t want her name used because she fears reprisal, describes falling into a depression during a six-week stint supervising 40 women on an Indochine line producing trousers. “Whenever workers didn’t meet a goal, the bosses would yell,” she says. In response, the women slowed down, hid in the bathroom, or went outside for air instead of working faster. Several times, she says, she witnessed a seamstress being hit on the back. When they had to work on their only day off or stay late, she adds, they didn’t receive the overtime promised. (Pattar says he’s unaware of any pay issues or physical attacks.) “I told my bosses, ‘The employees are not trained or qualified. You can’t expect them to deliver 120 pieces per hour. If you push them, they will just damage the products.’ ” She quit and now works at the front desk of a hotel, where she earns $63 a month, slightly more than at the factory.

Outsourcing to the developing world has allowed Western consumers to ignore or remain oblivious to the environmental damage and working conditions behind the rising sea of inexpensive clothes. That’s been harder since April 24, 2013, when more than 1,100 Bangladeshi textile workers died as their shoddily constructed Dhaka factory building, Rana Plaza, came down on top of them. Last year a coalition of nine organizations, including Human Rights Watch and Clean Clothes Campaign, asked 72 corporations to sign a “transparency pledge” promising to list on their websites the names and addresses of the companies making their clothes. Seventeen agreed to fully comply—Nike, Patagonia, and Levi Strauss among them—and many others agreed to partial compliance.

Companies at Hawassa Industrial Park pick up orders from many well-known brands. KGG Garment Plc from China sews for the Children’s Place Inc. Indochine sews for Levi Strauss & Co. and Guess along with making clothes that sell at Walmart. Some of the brands agreed to sign the pledge. (Walmart Inc. hasn’t.) But oversight isn’t easy. Human Rights Watch doesn’t even have an office in Ethiopia. In 2009 nongovernmental advocacy groups were all but banned when a law took effect saying such organizations can operate only if they source 90 percent of their funding from inside the country.

PVH, the parent company of Tommy Hilfiger and Calvin Klein, is the sole American manufacturer here. It’s an unusual company, viewing itself as a “supply chain pioneer,” Bill McRaith, PVH’s chief supply chain officer, said via email, because it sets out to develop the production capacity it needs and to directly oversee it. The company agreed to partial transparency, publishing the names of suppliers along with the countries of origin, but not the exact factory locations. PVH wouldn’t grant Bloomberg Businessweek permission to visit its factory in the new park but said it was reviewed by a reliable third-party agency.

McRaith described the government as very willing to help PVH meet its internally set standards. It was one of the reasons he gave for the decision, after a year of research, to incrementally move production to Ethiopia, along with Kenya and Uganda, in response to rising costs in China. (Another was the government adding infrastructure in tandem with building factories.)

“If you believe industrialization is a good thing and raises people up, out of poverty, where each generation has the opportunity to do better than the last,” McRaith wrote, “then the apparel industry has been the trigger in most developing countries.” As to the logistics of doing business in Ethiopia: “Maybe I am too old, but this is no different from China in the late 1980s to 1990s,” he wrote.

Managing an untrained workforce to produce goods rapid-fire is only slightly more challenging for the manufacturers than getting the goods out. Hawassa Industrial Park is 170 miles from the capital of Addis Ababa and 600 miles from the nearest shipping port in Djibouti. It is, practically speaking, in the middle of nowhere. Alemayehu Geda, an economist at Addis Ababa University, theorizes that although the companies would’ve preferred the industrial park to have been built closer to the port, “the ruling party wants to make it look like they’re pleasing everybody.”

The journey to the coast could get faster soon. The China Civil Engineering Construction Corp. has built a $3.4 billion, 450-mile railway from the capital to Djibouti. It opened in January to passengers, but cargo transport probably won’t start until Ethiopia’s political fracas cools. For now, Hawassa’s manufacturers have to truck their goods to the port. It’s an ordeal. The route cuts through the homeland of the Oromo. Protesting farmers have blocked traffic for hours. Charred buses and trucks speckle the dry landscape, and it’s not uncommon for 18-wheelers to collide with camels, causing delays. Meanwhile, there are three customs checkpoints, and almost everything is done on paper. Holidays add an extra wrinkle: The Ethiopian Orthodox Church observes myriad saint’s days, and customs agents might take off a month of each year, all told, to celebrate. The result is that drivers can spend two or three days stuck at customs, sleeping in their trucks.

It’s also difficult to source supplies domestically. One Sri Lankan shirt company, Hirdaramani Group, says it imports five shipping containers of cardboard boxes from home each month. “If you buy them in Ethiopia,” says manager Gayan Nanayakkara, “they have staples in them, and they don’t make it through the metal detectors at customs.”

This could, in theory, be an opportunity for small, local entrepreneurs. In 2014 the World Bank Group started a $270 million project to stoke “Ethiopian competitiveness,” in part by “enhancing industrial zone linkages to the local economy.” But the work involves fording a cultural divide. More than three years in, the World Bank is still readying seven homegrown companies—makers of boxes, buttons, and finished leather—for their entree into the global supply chain. Susan Kayonde, a World Bank development specialist, wrote in an email that “the impact of our support (e.g., sales growth, increased employment) can only be gauged in three to six months.” The new businesses are just about to start procuring the machines and training workers.

The difference between the World Bank initiative and loans from the Chinese government is that the latter don’t come with philanthropic directives, which at least gives the illusion that Ethiopia is steering its own growth. Stefan Dercon, an Oxford University development economist who recently spent a year studying Ethiopian factories, worries that in borrowing billions from the Chinese, the country is “sailing into the wind, and they might tip over. I really think they need to slow down with borrowing and infrastructure development.” He’s rooting, though, for Ethiopian industry. “Eventually wages will increase, when more foreign companies arrive and begin competing for workers,” Dercon says. Until then, factory jobs are better than the alternatives: “These women might be spending their days shaping cow dung into pies for fuel.”

Alemayehu is a skeptic. He says Ethiopia’s industrial parks might not survive. “I read about one Chinese shoe company, Huajian,” he says. “Their logistical costs increased eightfold in Ethiopia. What if all these companies just exploit all the incentives and then leave a few years from now? Where does that leave us?”

In papers, Alemayehu has parsed his government’s claim of 11 percent annual growth. “Things are not as rosy as it is painted in the official figures,” he says. Alemayehu estimates that the actual growth rate is about 6 percent. He excoriates the government for trying to lure foreign investors by devaluing its currency. In late October, for example, the country lowered the worth of the birr by 15 percent, to 3.7¢ to the U.S. dollar. “I interviewed 100 exporting firms,” he says, “and nobody mentioned the exchange rate as a problem. Everyone says the problem in Ethiopia is logistics and bureaucracy. By devaluing the birr, they only hurt the poor. Food prices have already risen.”

Nevertheless, some young members of this new labor force brim with optimism. “We are living better now in the city,” says one 18-year-old line worker who sews pant hems for Indochine. (She asked that her name not be used.) She grew up 50 miles away with seven siblings on a 2.5-acre farm and now shares a room with another worker at a tin-roofed concrete apartment block on the outskirts of Hawassa. “In the countryside, we have no way to stay neat and clean. And we are getting experience,” she says, also speaking for her roommate. She hopes one day she can be self-employed as a tailor.Her monthly salary is $23.70, plus $7.30 for meals and, if she doesn’t miss a day of work, a $7.30 attendance bonus. She pays $9 a month for her share of the rent on her apartment, leaving her $29.30 if she gets her bonus. She spends about 50¢ a day on food and struggles to cover laundry soap and transportation to church. “The soap is expensive,” she says. Recently she missed a few days with a cold. She didn’t get her bonus and worries she’ll go into debt. Her room is illuminated by a single dangling lightbulb. She sleeps on the bare concrete, and the walls are almost naked, save for a banner that reads, “Whether my life is comfortable or uncomfortable, I still thank my God.”

– Bill Donahue with Andualem Sisay Gessesse and Fiona L

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh