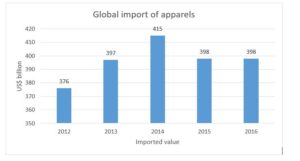

A number of prominent global apparel retailers have gone bankrupt in the recent years. The trend started in 2016 and it continues in 2017. Many are planning to shut down their outlets. There is a decreased demands of apparel products and exporting countries have seen slow down of exporting performance in the recent years.

Many experts say that this is due to slow down of apparel consumption. According to newspaper reports, the global market for clothing products came down to $444 billion in 2016 from $450 billion in 2015. China’s market share slid to 36.4% from 39.3% last year.

India based magizne Textile Excellence report that US has slowed down its apparel purchases for some time now. The report said that US imports in 2016 at US$ 80713.83 million, were 5.23% lower than in 2015. Imports from China were down 8.58%. Except Vietnam (2.3% up), imports from the top 10 exporters has fallen in 2016.

The report said that Myanmar witnessed a steep increase in its exports to the US. Exports were to the tune of US$ 73.51 million during 2016, an increase of 79.31% over that in 2015 while US apparel imports from Ethiopia were up 85.13% to US$ 32.67 million in 2016 compared to the previous year. The report also said that imports from Oman at US$ 24.05 miillion grew 170.87% in 2016. It concluded that US has been importing less.

Retailers are closing their stores

And retailers are struggling. In early 2016, prominent US retailer J Crew showed signs of failing. Reports say that the company has built up huge debts.

Another prominent apparel retailer-Target is also struggling. It reportedly faced with unsold stocks. Report said that it has put most of this pressure on the suppliers, tightening delivery schedules, charging higher fines and penalties.

Gymboree is scaling back its playground. It’s closing more than a quarter of its kids’ clothing stores as it tries to adapt to an “evolving retail landscape.” The company filed for Chapter 11 bankruptcy protection on June 11; exactly one month later, it announced it was shutting down 350 of its Gymboree and Crazy 8 locations, out of a total of nearly 1,300.

Payless ShoeSource filed for Chapter 11 bankruptcy protection in April and said it would shut down around 400 of its weaker stores. In May, the company indicated it could close 408 additional locations. Reports said that the discount footwear chain — founded more than 60 years ago in Topeka, Kansas — has found itself running behind online competitors.

Mall mainstay J.C. Penney says it’s shutting down as many as 140 of its department stores — up to 14 percent of the total — by mid-2017. Reports said that the company is offering 6,000 employees early retirement.

Department store giant Macy’s continues shutting down its stores. In 2016, the departmental store shut dozens of stores. It began 2017 by announcing plans to close 68 more of its locations, including a store in downtown Minneapolis that opened in 1902, according to newspaper reports. The company estimates that 3,900 jobs will be lost as a result of the closures.

In early 2017, women’s clothing retailer The Limited announced it will shut down all 250 of its stores.The company showed signs of doom during its major holidays sales (with a no-returns policy) and ultimately filed for bankruptcy. Business Insider reported that some 4,000 workers were laid off.

Abercrombie & Fitch which is famous for torn jeans and ripped models says it will shut down 60 of its U.S. stores in 2017 as their leases expire.

Contemporary apparel, footwear, and accessory brand Guess is closing 60 of its stores by the end of the year. It said in a statement that it’s shrinking its footprint because its business in the Americas has been “soft.”

American Apparel filed for bankruptcy early in 2017 and has since closed all of its more than 100 U.S. stores. Reports say Canada’s Gildan Activewear acquired the American Apparel brand but passed on taking over the retail stores.

Women’s apparel retailer BCBG Max Azria is also going to bankruptcy court in 2017. Reports said that it filed for Chapter 11 in March and announced that it would shut 120 of its locations which is more than a quarter of the total.

Teen fashion retailer Wet Seal closed its remaining 171 stores early 2017. Reports say that the company had been shrinking since filing for bankruptcy protection in January 2015.

Teen apparel chain rue21 shut down some 400 stores of its nearly 1,200 stores in April and announced a bankruptcy filing the following month.

Women’s clothing seller Bebe closed all 175 of its brick-and-mortar stores this spring. The company said that it would explore new strategies for its business.

The Gymboree Corporation has plans to close hundreds of locations.

Newspapers reported that designer jeans and clothing retailer True Religion has filed for Chapter 11 bankruptcy protection. “After a careful review, we are taking an important step to reduce our debt, reinvigorate True Religion’s iconic brand and position the company for future growth and success,” John Ermatinger, President and CEO of True Religion quoted as saying.

Women’s clothing retailer Ascena Retail Group is planning to close hundreds of stores. The company said that at least 268 of those stores will definitely be closed by July 2019. The remaining 399 stores will be shut down if rent concessions aren’t obtained through negotiations with landlords, it said. However, it didn’t specify which locations will be closed.

Fickle consumer who is always on the lookout for discounts

Textile Excellence reported that retailers have been blaming their troubles on the “fickle consumer who is always on the lookout for discounts.”

“And they excuse themselves for having traditional retail models that do not permit them to react as fast as Zara to consumer choices. The retailers’ lack of understanding of consumer behavior and preferences, their adamancy to continue to remain unadaptable have been their undoing,” it said.

China became World’s largest retail markets

In 2016, China surpassed the US to become the world’s largest retail market with total sales of $4.886 trillion, compared with $4.823 trillion in the US, according to market research company eMarketer.

It research organization said that China remained the world’s largest retail ecommerce market, with sales exceeded to $899.09 billion in 2016, representing almost half (47.0%) of digital retail sales worldwide.

In 2011, Boston Consulting Group reported that China’s fashion market is expected to triple in size to more than 1.3 trillion yuan ($201.3 billion) in the next 10 years driven by the rise of the middle-class affluent consumer in China

Growing online apparel sales

In 2016, a research by Goldman Sachs predicted that online apparel and accessories sales in the U.S. could grow 20% over the next four years, compared to just 10% six years ago. The report said that nearly 35% of millennials now buy most of their apparel online, compared to about 30% for consumers between 35 and 44 years old, and 15% for those between 45 and 54. Goldman also said that wealthier consumers, digital technology advances, and Amazon’s assertive move into apparel and accessories will also help fuel the growth of online sales in those categories.

In UK, in July ONS retail sales figures show that the volume of online spending increased year-on-year by 15.9% and by 1.8% compared to last month. It said that last year, one-third of online retail came from mobile. Over half of traffic to retail websites is now directed via smartphones and tablets, with mobile commerce now accounting for 36% of UK e-retail sales and rising to 40% for clothing and apparel websites.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh