Published in Livemint on March 21, 2018

India’s labour-intensive industries are languishing. Not only are exports of these industries in the doldrums, industrial production data also shows tepid growth in these sectors.

What’s more, imports of labour-intensive products are increasing. These trends could have a severe impact on employment.

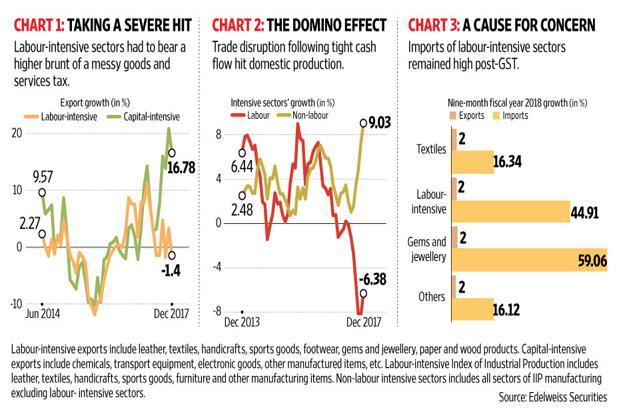

Consider exports. Exports of India’s labour-intensive industries such as gems and jewellery, textiles and leather goods are suffering. Things began to go downhill for them after the goods and services tax (GST) was implemented in July last year. And they have failed to recuperate so far, unlike the capital-intensive businesses (see Chart 1).

Labour-intensive sectors were also among the key casualties of the note ban. Small and medium-sized exporters could not cope with the rigours of GST, which came close on the heels of demonetization.

Increased cost of compliance and an ambiguous refund mechanism resulted in a spike in working capital needs of exporters. Consequently, their supply chains were affected and the industrial production data mirrors that pain.

As Chart 2 shows, the Index of Industrial Production (IIP) for labour-intensive sectors such as leather, textiles, handicrafts, sports goods, furniture and other manufacturing items contracted sharply since April last year. They are still struggling to deal with the aftermath of GST. On the other hand, IIP for non-labour intensive sectors has recovered after the initial weakness.

One key reason why the labour-intensive sectors had to bear the brunt of GST was the large share of unorganized firms.

But that’s not all.

“What is also worrying is that imports in these sectors have risen sharply in the mentioned period. Historically, exports/imports of these sectors have moved in tandem. This suggests that it’s disruption in the supply chains of these sectors that is hurting rather than weakness in end demand,” Kapil Gupta, vice-president at Edelweiss Securities Ltd said in a report dated 28 February (see Chart 3).

A slew of measures have been announced by the GST Council to ease the liquidity crunch faced by exporters, but it is too early to conclude if that objective has been achieved.

Unfortunately, even if these measures yield the desired results, it is a bumpy road for these industries as far as getting funds is concerned.

The recent fraud at Punjab National Bank will make borrowing difficult for the gems and jewellery industry, having a cascading impact on their revenue growth. Of course, it will also have an impact on employment.

CARE Ratings Ltd anticipates foreign trade in jewellery to decline by 5-6% (in value terms) in fiscal year 2019 and sales to reduce by around 16%. Closure of scam-hit Gitanjali Gems Ltd and Firestar Diamonds would render around 3,000 permanent staff of these two companies jobless, it said in a report dated 27 February. It would also impact another 7,000-8,000 non-permanent staff directly and indirectly, added the ratings agency.

While these numbers may be small, the overall sluggishness in the labour-intensive sectors does not bode well for job growth.

Other factors too are important. For instance, in the textiles sector, there is cut-throat competition from neighbouring countries Bangladesh and Vietnam. Unfavourable currency movements and the temporary impact of revision in duty drawback rates during the past one year, make things worse.

Key segments of India’s textile exports include yarns, towels and apparels.

“India’s yarn exports have remained under pressure during much of the current fiscal, with the exception of recent months. India’s apparel exports have also remained extremely weak in the past few months mainly because of a sharp inexplicable decline in apparel exports to the UAE, by as much as 45% since June 2017, which has pulled down the total apparel exports of India,” Jayanta Roy, group head (corporate sector rating) at Icra Ltd, said in an emailed response. UAE stands for the United Arab Emirates.

Roy added that one should closely watch developments in the modified Trans-Pacific Partnership and the EU-Vietnam Free Trade Agreement, which could provide a further push to Vietnam’s position in the global apparel trade. EU stands for the European Union.

And don’t forget the risk that looms from rhetoric on protectionism in the US, an important trading partner.

In short, this means revival in exports of labour-intensive sectors is an uphill task.

“Revival in these sectors is extremely critical. Else, weakness in production and exports could spill over into labour markets and hence overall consumption. Indeed, recent weakness in rural wage growth (wage growth has slowed from near-term peak of 7% in May’17 to 4% in November’17 as per latest data) could perhaps partly be on account of weakness in labour-intensive industries,” said Gupta of Edelweiss Securities.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh