The traffics at the Chittagong port have increased in the last couple of years. However, the infrastructures were not improved in line with the increased traffics. The result is the congestion. Often heavy congestions hamper activities in the port which affects Bangladesh’s export performance. Business are incurring losses as the congestion has increased operation cost of their businesses. About 90% of the country’s export and import is done through Chittagong port, located by the estuary of the Karnaphuli River.

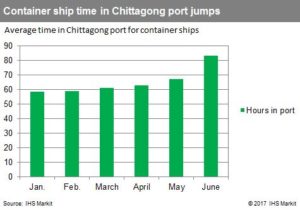

The recent congestion began to mount in April, when average time in port was 62.7 hours, and jumped in May to 67 hours. Each day an average of 15 to 20 box ships waits at the outer anchorage for unloading. Bangladesh’s Prothom Alo newspaper reported that since 13 May, on an average every day, around 15 cargo vessels have to wait at the outer anchorage of the Chittagong port. The report said that although it normally requires one day for unloading goods, took 12 days during the congestions. According to Global trade intelligence provider, JOC the congestion, which has driven up ships’ average time in port 43.1 percent to 84.3 hours between January and June, appears to be worsening. Citing IHS Markit data, it said that July’s average time in port for container ships was already at 54 hours with just less than half of the month left. The JOC report said that the loss of nearly 2 meters (6.6 feet) in draft has only made matter worse. Six of the 13 jetties at the port are in the range of 6 to 7 meters, preventing ships with drafts of 8.5 meters, which commonly call the port, from berthing, and forcing them rely on just two jetties able to accommodate such ships. It said that the loss of nearly 2 meters (6.6 feet) in draft has only made matter worse. Six of the 13 jetties at the port are in the range of 6 to 7 meters, preventing ships with drafts of 8.5 meters, which commonly call the port, from berthing, and forcing them rely on just two jetties able to accommodate such ships.

High Cost

According to JOC, after cranes at the two jetties unload containers from 8.5-meter-draft vessels to reduce their draft to 6 meters, the ships are shifted to other jetties with depth of 6.5 meters to unload the rest of the containers and the process repeats. This is leading to higher costs on top of the delay because of the need to pay two different groups of workers to unload the ships. Meanwhile, ocean carriers have been pushing congestion surcharges for Chittagong-bound container ships from Shenzhen, Shanghai, and Guangzhou by $50 to $275, according to port officials.

From June 15 Maersk Line began charging $600 per container into Chittagong ships from north and south Asia, up was from $400 to $450 in November last year.

Prothom Alo reported citing Bangladesh Bank that 26 per cent of the commodities are imported from China. A total of 1,00,000 containers (each 20 foot-long) arrive at the Chittagong port every month. If a $100 for each container is collected, the businesses have to spend an additional Tk 800 million every month.

Traffic increased over the years

According to JOC, Chittagong’s port traffic jumped 16 percent year over year in 2016 to 2.3 million TEU, nearly double its designed annual capacity of 1.7 million TEU. Since 2012, the port’s capacity has grown by only 8,000 TEU while the number of container-handling equipment has been flat. However, newspaper reported that However, no jetty has been constructed in the last nine years.

Capacity has not increased

The Financial Express reported that the capacity of Chittagong port has expanded around 8000 Twenty-foot-Equivalent Units (TEUs) in five years while the number of cargo-handling equipment remained almost the same.

In a marked contrast, the container traffic increased by nearly 1.0 million TEUs to 2.3 million TEUs over a period of five years, starting from January 2012.

Port-insiders said the seaport has an annual capacity of holding 1.7 million TEUs.

Neighboring countries expanding their port capacity

Sri Lanka

In 2016, Sri Lanka’s Colombo container port planned a major 33% expansion in capacity to 9.6 million TEU by the end of 2017, from 7.2 million TEU, newspaper reported.

The East Container Terminal is being developed and bids to take a joint venture share in the project are expected to be invited soon under the public private partnership scheme, Tissa Wickramasinghe, general manager at Colombo International Container Terminals, or CICT, said in an interview on the sidelines of the TOC and Container Supply Chain Conference in Singapore last week.

Colombo port

CICT is Sri Lanka’s first deepwater container terminal and has a total handling capacity of 2.4 million TEU. In addition, there are two shallow water terminals at Colombo port, each 15 meters in depth with berthing capacity of 3.4 million TEU and 1.4 million TEU.

At ECT, around 400 meters of berths have already been built by Sri Lanka Ports Authority, or SLPA, and the balance 800 meters will be completed after the joint venture arrangement with a private entity is finalized, he said.

Myanmar

In 2016, Japan’s Toyo Construction Co. and JFE Engineering Corp. have won a contract to build a new container terminal at the Port of Thilawa near Yangon, Myanmar, to expand one of the country’s key logistics hubs.

The new terminal is needed to handle more large ships and meet growing demand and will have an annual capacity of 187,000 twenty-foot-equivalent units when it is completed in the autumn of 2018, according to the Japan International Cooperation Agency, a government-affiliated aid organ.

The scope of work by the Japanese duo involves the removal of 208,000 cubic meters of sediment and construction of an 18-hectare container yard, and two jacket-type berths with depths of 10 meters (32 feet), lengths of 400 meters and widths of 40 meters.

The companies behind the project recently signed the approximately 13.8 billion yen ($118 million) contract with the Myanmar Port Authority, Toyo Construction said on Thursday.

The project will be funded by low-interest, official yen loans that are part of Japan’s official development assistance program for developing countries.

Yangon is Myanmar’s largest city and former capital, but the government has decided to expand the Port of Thilawa because the Port of Yangon, a river port, is not deep enough to receive large container ships.

The Port of Thilawa can currently receive vessels of up to 20,000 deadweight tons. “The new container terminal at the Port of Thilawa will be able to receive two ships of up to 20,000 DWT at the same time,” a Toyo Construction spokesman said.

Thilawa is home to Myanmar’s first special economic zone, which formally opened for business in September 2015 as a large-scale joint project between Myanmar and Japan.

Nippon Express Co., Japan’s largest international freight forwarder, set up its second Myanmar subsidiary in the Thilawa SEZ in December, further strengthening its footprint in the increasingly promising Southeast Asian market.

The Tokyo-based company, also known as Nittsu in Japan, established Nittsu Logistics Myanmar Co. and will also build a new warehouse in the Thilawa SEZ.

Nippon Express established its first Myanmar subsidiary, Nippon Express (Myanmar) Co., in Yangon in December 2014, joining a growing army of Japanese transportation, logistics and other firms aiming to cash in on what is widely seen as Asia’s last frontier market.

As Myanmar emerges from years of international isolation and economic sanctions, it has drawn growing attention from foreign investors as the last economic frontier in Asia. Myanmar is rich in natural resources, has a relatively large population of about 51 million and is also sandwiched between China and India, the world’s two most populous countries.

Myanmar has the potential to become a lucrative consumer market in the future if its economy develops smoothly and its people’s income grows. Thanks to its cheap labor, Myanmar has also attracted growing attention as an investment destination from Japanese and other foreign manufacturing companies that are reviewing their production and sourcing strategies in Asia amid rising labor costs in China.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh