Published in The Independent on October 29, 2017

Acting as a backward-linkage industry of the Readymade Garment (RMG) sector and other export-oriented industries, the net export earnings of the Garments Accessories and Packaging (GAP) sector was $6.70 billion during the 2016-17 financial year (FY).

Experts in the sector say it earned around $1.12 billion in FY2016-17 by exporting to the Netherlands, South Africa, Pakistan, India, China, Ethiopia, Indonesia, Italy, Sri Lanka, Turkmenistan, Germany, Austria etc. Investment in this sector is currently about Tk 35,000 crore, and value addition to the tune of 30 per cent.

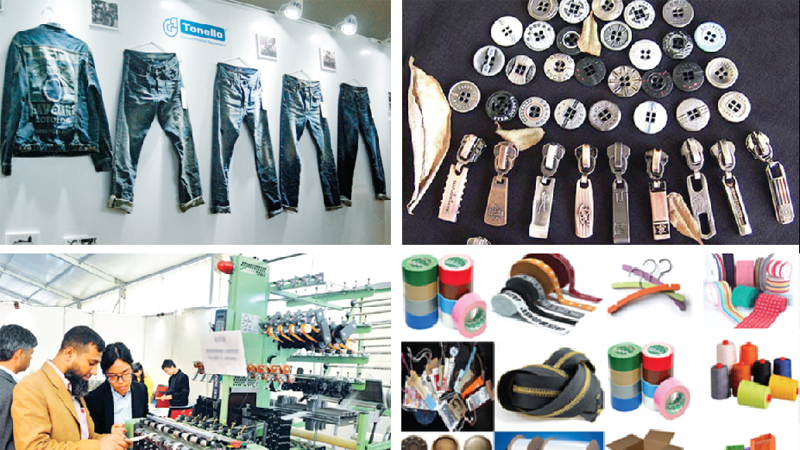

The accessory makers and packagers supply about 30 types of products to the RMG sector, say stakeholders.

Experts also maintain that a resolution of the compliance issue, corporate tax reduction, policy support, split from the RMG sector, recognition as an accessories industry, and the creation of a national data base could help this sector double its export earnings by 2021.

Challenges

Describing the challenges, BGAPMEA President said, “It is difficult for us to meet 100 per cent compliance requirement because this sector is still growing, and we have only 20 to 25 per cent factories that are big and built on their own land.”

Abdul Kader Khan cited an example, saying compliance factories require fire doors, day-care centres and other amenities, which small entrepreneurs find difficult to provide.

One ‘fire door’ costs Tk 1 lakh, an expense that big entrepreneurs can afford but a single-unit producer, manufacturing one product such as cartons or poly, finds difficult to pay for, he added.

Talking about factory numbers, Khan said, “Currently, the BGAPMEA has 1,500 members and 1, 200 among them are active.”

When asked whether Bangladesh was capable enough to produce accessory products locally, he said, “Around 95 per cent of accessory products are being produced locally and 5 per cent is being imported.”

About imported accessory materials, Khan said, “We import 80 per cent of the raw materials and 20 per cent are locally sourced. So we have to overcome this challenge as well.”

Tax burden

Khan pointed out that Garments Accessories and Packaging (GAP) makers were paying 35 per cent corporate tax, while the Readymade Garment (RMG) manufacturers paid 12 per cent.

“So, this amounts to discrimination against our sector, though we are providing about 95 per cent of Garments Accessories and Packaging goods to apparel manufacturing factories. Unless we address this discrimination, it won’t be possible to achieve the target of $50 billion by 2021,” he added.

The BGAPMEA president said, “The government is providing cash incentive to promote export diversification, but we don’t need any cash incentive. We need the government’s help to resolve our compliance issues and get financial support.”

He said that in achieving the $50 billion target by 2021, this sector would contribute at least $10 billion dollars. “So we need policy and financial support from the government,” Khan stressed.

President of the Export Association of Bangladesh Abdus Salam Murshedy told The Independent, “Europe has 1 per cent interest rate, while our interest rate is 12 per cent. That is the biggest obstacle to the growth of the business.”

Need for policy

He said it was important to formulate an export monetary policy because, after Brexit, the exchange rate went down from Tk 115 to Tk 98. “It happened because of our weak policy support,” Salam Murshedy added.

Research Director for the Centre for Policy Dialogue (CPD) Golam Moazzem said the GAP industry should not be treated as the backward industry. In his opinion, it should be identified and recognised as an independent entity and named an ‘accessories industry’.

“In 2027, Bangladesh will become a middle-income country. After that, we will not get the Least Developed Country (LDC) facilities,” he reminded.

“So, before that happens, we need to utilise the opportunity, because our labour cost will go up after 2027,” Moazzem added.

The CPD research director also said that China was moving out of apparel manufacturing and Bangladesh could seize the opportunity to grab more foreign buyers.

Moazzem urged the Export Promotion Bureau (EPB) to build a national database where all data concerning the GAP industry would be readily available.

President of the Federation of Bangladesh Chambers of Commerce and Industries (FBCCI)

Shafiul Islam Mohiuddin said the lead time was an extremely important factor in choosing a supplier for manufactured parts.

“During the last financial year, the GAP sector directly exported $1.12 billion worth of goods, a fantastic figure so far. But to hold on to the position, we need to be more efficient to reduce the lead time and increase export.”

About global opportunities, Bangladesh Investment Development Authority (BIDA) Executive Chairman Aminul Islam said, “We have a $6.70 billion dollar industry, while the global market is worth 600 billion dollars. So, we have an immense opportunity ahead to penetrate the global market.”

Describing the challenges, Second Vice President of BGAPMEA Moazzem Hossain Moti said, “The export market is subject to highly volatile price fluctuations. Prices of raw materials of the GAP sector increased by15–20 per cent. On the other hand, the selling price of finished products fell by10 per cent. Production cost is rising, but product cost is falling.”

He said the Garments Accessories and Packaging (GAP) sector was badly hobbled inadequate gas and electricity connections in addition to other infrastructural shortcomings.

Moverover, lack of skilled manpower was impeding the sector’s growth.

Prospects

Pointing to another drawback, he said, “Some export-oriented sectors are getting cash incentives but the GAP sector, despite being 100 per cent export-oriented, has never got cash incentives since its inception.”

Mashud HK Siddique, the director of Montrims Ltd, the largest accessory maker in the country, told The Independent that Montrims was a 100 per cent export-oriented company with 10 per cent direct exports and 90 per cent foreign exports which mean merchandise re-exported substantially the same form in which it was imported.

“The biggest buyers are our RMG factories that produce clothes for global brands like H and M, Tommy Hilfiger, and many others. This means that the accessories we produce are of international standards and are used by global brands,” he added.

Montrims Ltd, a concern of the Mondol Group of Industries, produces around 25 accessory items, including woven labels, leather badges, stone and metal motiffs, rubber patches, gum tapes, satin and cotton ribbon hangers, among other items.

The Prime Minister’s economic affairs adviser, Mashiur Rahman, recently said at a national seminar, titled ‘$50 billion RMG export by 2021: Role and challenges of garment accessories and packaging sector’, that a variety of taxation rates was affecting business growth in Bangladesh.

“Wide ranging tax rates are no required or are good for any country. Tax rates should not be varied for a product that has a demand in the international market,” Rahman said.

“Unfortunately, in Bangladesh, products in demand have the highest tax rates. This isn’t a good sign for business growth,” the PM’s adviser said at the seminar.

Rahman advocated a reduction in the corporate tax for the RMG sector, saying the sector would not be able to surge ahead by paying a 35 per cent tax.

BGAPMEA officials said, (BGAPMEA) represented about 1600 export oriented garment accessory and packaging industries in the country.

Over 6 lakh people work in this sector, 20 per cent of them women. After all, it is the first backward-linkage industry of the RMG sector, officials added.

CPD RMG Study Stitching a better future for Bangladesh

CPD RMG Study Stitching a better future for Bangladesh